Postgraduate Retail Banking Certificate Programme

₹100,000 Original price was: ₹100,000.₹99,000Current price is: ₹99,000.

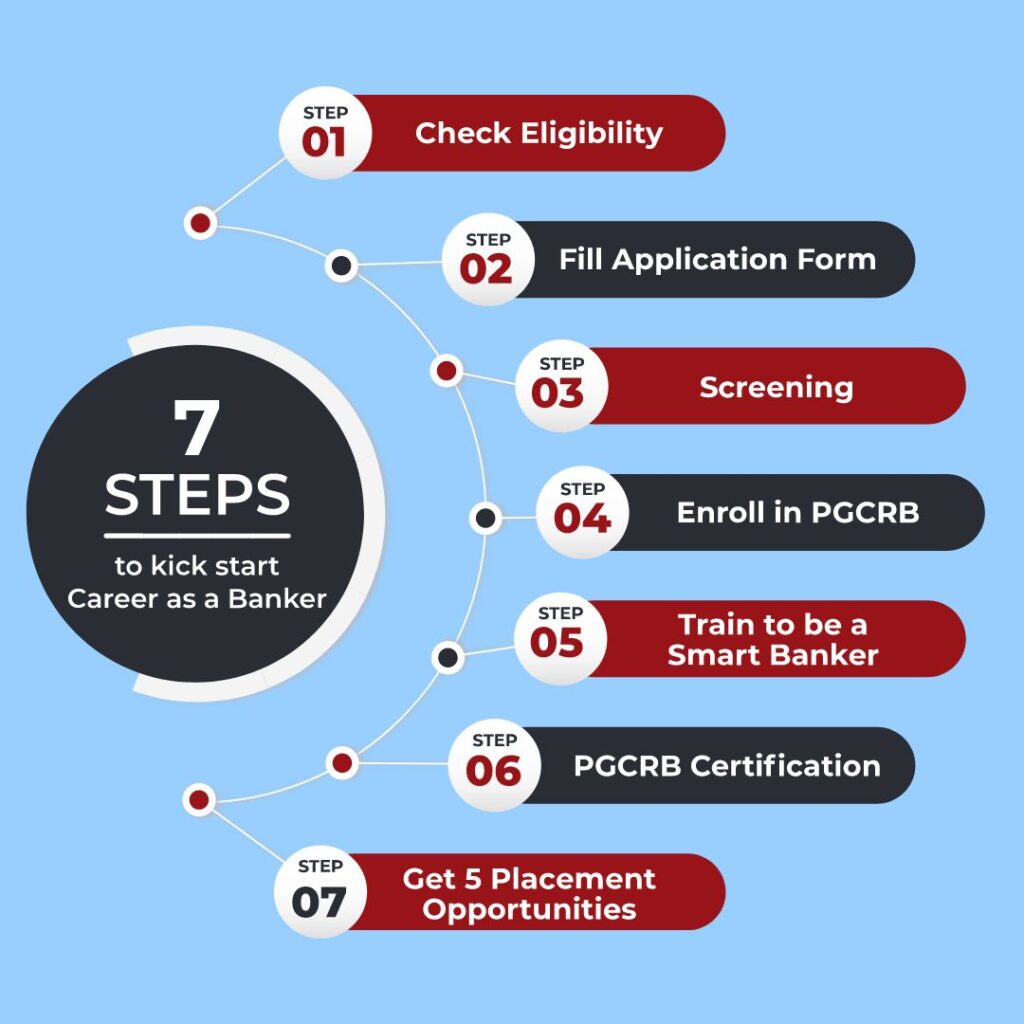

The flagship programme, the Post Graduate Certificate in Retail Banking (PGCRB), prepares recent graduates and postgraduates to become “Smart Bankers” through a rigorous four-month training programme led by bankers with specialised knowledge in their respective fields.

As an intensive programme, PGCRB gives students hands-on experience interacting with the Bank’s clients, goods, procedures, and systems. To prepare students for the work of a Teller/Customer Service Officer, the programme heavily involves them in case studies, persona-based problem solving, role plays, and assignments. Our knowledgeable and seasoned instructors serve as mentors throughout the duration of the learning process.

Description

Postgraduate Retail Banking Certificate Programme

Preparing bankers for retail banking who are not just diligent professionals but also morally upright people

The Structure of Our Programme

The introduction of sophisticated models such as payments and small financing banks has lately taken place in India’s well-capitalized and well-synchronized banking system.

Banks are becoming the first choice for financing among India’s rapidly expanding business community, indicating that the nation’s banking industry is likewise expected to see robust expansion. For educated workers, this expansion is creating a plethora of employment options in the financial industry, including retail banking.

The flagship programme, the Post Graduate Certificate in Retail Banking (PGCRB), prepares recent graduates and postgraduates to become “Smart Bankers” through a rigorous four-month training programme led by bankers with specialised knowledge in their respective fields.

As an intensive programme, PGCRB gives students hands-on experience interacting with the Bank’s clients, goods, procedures, and systems. To prepare students for the work of a Teller/Customer Service Officer, the programme heavily involves them in case studies, persona-based problem solving, role plays, and assignments. Our knowledgeable and seasoned instructors serve as mentors throughout the duration of the learning process.

Among them are the following:

- Acquiring the abilities needed to work in private sector banks

- Overview and observance of daily operations, policies, and banking functions

- Assist them in understanding the principles of management and cost accounting as well as how they affect the process of making financial decisions.

- Teaching people about the many kinds of financial institutions and how they function within the financial markets.

- Educating them on the regulatory obligations relevant to their industry

Programme Goals

- Students who complete the Post Graduate Certificate in Retail Banking are guaranteed to possess the necessary real-world experience to pass the interview.

- The knowledgeable faculty created the extensive training programme, which helps students hone their hard and soft talents.

- This post-graduate certificate program’s primary goal is to maintain India’s pool of highly educated banking professionals.

Result of Retail Banking Education

👉🏻 Students who complete a postgraduate course in retail banking will have a fundamental understanding of retail banking’s guiding principles as well as its offerings.

👉🏻 The changing realities of financial inclusion are captured by the students in this course, which also emphasises various areas of banking, prospecting and CASA acquisition, complaint resolution, and other customer service components.

Eligibility

The candidates must meet the requirements listed below in compliance with the rules established by Banks.

Regular Graduation with grades more than 50%

Less than 26 years old

The time between studies shouldn’t be more than a year.

A two-year gap should not occur after studying.

CIBIL Score: 700 or below or -1

Strong Social Skills

This Programme Is for Whom?

Graduates and post-graduates seeking to advance in the banking industry.

Candidates in the workforce seeking to launch a career in the BFSI industry.

Criteria for Disqualification

Failure to pay EMIs by the due date.

Submitting false or inaccurate documentation.

Misbehaviour and misapplication of institute funds.

Propagating incorrect information and rumours.

Eduoose Skill PGCRB CERTIFICATE

You would be qualified to obtain a certificate from the Institute of Professional Banking upon completion of your Post-Graduate Certificate program in Retail Banking. This credential will help you advance in your banking profession and is accepted by many of the best private sector institutions.

How Does PGCRB Help You?

Add Your Heading Text Here

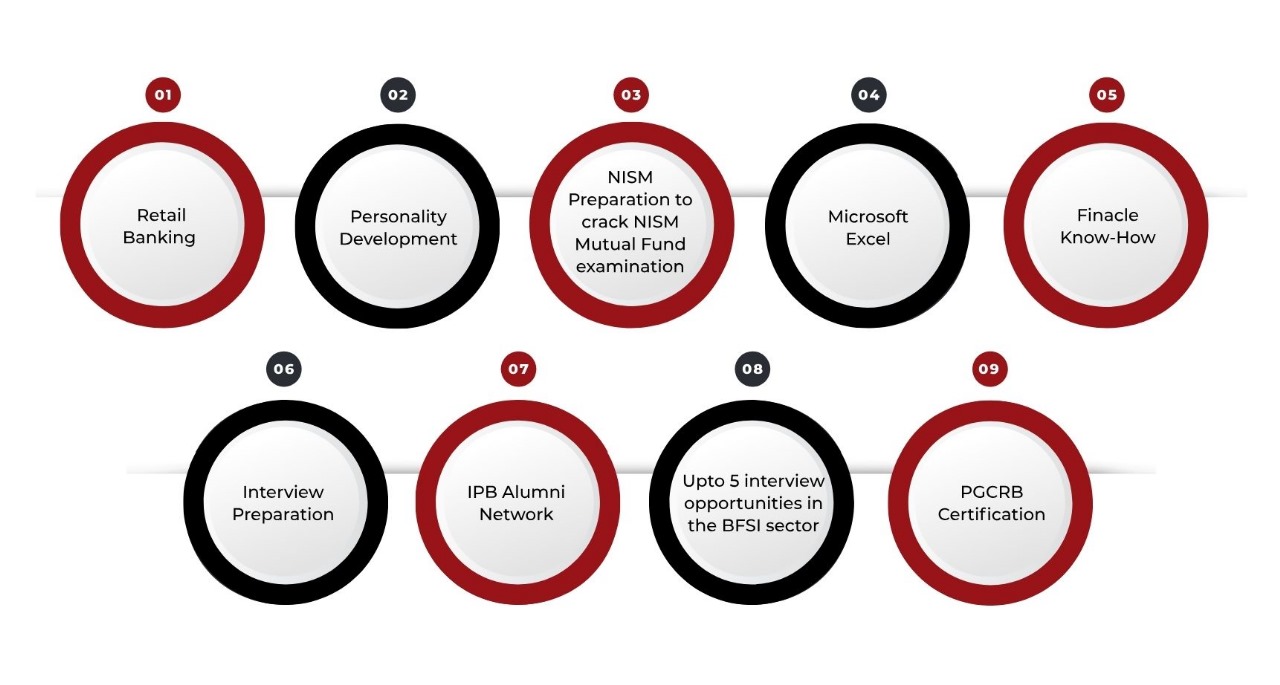

The list of modules for the banking course is provided by the Institute of Professional Banking.

Institute of Professional Banking offers the below list of modules for banking course

- Introduction to Banking Sector

- Indian Financial System

- RBI & Banking Regulations

- Types of Deposits & Interest Calculations

- Know Your Customer (KYC) Policy

- Types of Customers (Individual & Non Individual)

- Documents Required to Open Various Types of Accounts

- Account Opening Process & Due Diligence

- NRI Accounts (Types & Documents required)

- Law Related to Negotiable Instruments (NI Act)

- Cash Operations (Receipt & Payment)

- Counterfeit Notes & Clean Note Policy

- Clearing Operations (CTS) : Process & Benefits

- Payment Instruments & Electronic Fund Transfer - RTGS, NEFT, IMPS & UPI

- Account Operations - Non Financial Transactions (Printing of Statement, Passbook, Nomination, Form 15G / 15H, Change of Address, Dormant Account Activation)

- Third Party Products (TPP) - Sale & Service of Mutual Fund & Insurance

- Foreign Exchange

- Retail Loans (Documentation & CIBIL requirement)

- Prospecting, Customer Profiling, Cross Selling, Lead Generation & Conversion

- Customer Service Skills & Complaint Handling

- Digital Banking

- Core Banking Solutions

- Digital or Alternate Channels (ATM, Net Banking, Mobile Banking, Debit / Credit / Prepaid Cards)

- Audit & Risk

- Compliance Tools

- Frauds & Prevention Techniques

- Finacle Overview

- Frequently Used Commands

- Practical Illustration

- Concept & Role of Mutual Fund

- Offer Document

- Return, Risk & Performance of Funds

- Selection of Financial Products

- Financial Planning

a) Soft Skills

- Importance of Soft Skills

- Effective Communication Skills

- Customer Service & Handling Skills

- Listening Skills

- Confident Body Language

- Dressing and Grooming Etiquettes

- Professional Work Ethics

- Stress Management

- Email Etiquettes & Resume Writing

- Effective Interview Skills

b) Microsoft Excel

- Introduction to Excel

- Formulas & it's Functions

- Data Formatting & Alignment

- Sorting & Filtering

- Creating Tables, Charts & Graphs

- Pivot Table

Importance of TRAINING

- Since human resources are the primary source of these firms’ resources, training and development of private managers and human resources is the largest concern for each banking organization.

- The greatest financial services are being offered under one roof by an increasing number of commercial and public banks these days, which has transformed banking into a non-traditional industry.

- Training programs must be used to continually develop the knowledge and skill sets of the workforce throughout the firm due to the persistent challenge given by the banking sector’s fast changing business environment.

- Training is seen as a helpful tool, particularly when discussing the nature of the job performed by banking organizations and the caliber of the knowledge and skills needed to match it. Through appropriate administrative measures, it also effectively affects the human element’s productivity.

- Currently, engineering and medical schools predominate in India, making it challenging for the country’s sizable banking sector to identify the schools that provide the sole talent pool with the necessary capabilities for the banking business.

- As a result, instead of searching the major cities for talent, the banking sector now needed to look in small towns and rural areas of India. To meet the necessary capability for the banking sector, this talent pool just has to be polished and given training programs.

- Additionally, banking needs to become modern and dynamic in order to meet the ever-increasing demands of households and businesses and to elevate this industry to the pinnacles of worldwide excellence. This calls for a mix of highly skilled and talented laborers with the newest technological advancements.

Training PROGRAM

The Eduooze Skill both present and prospective bank workers specialized training programs. These training courses are accredited banking graduation requirements. These programs use a combination of classroom instruction, projects, and hands-on training in a dummy branch.

Typically, the training program covers banking procedures such as:

- Daily Settlement Processes

- Procedures for Transactions

- Recognizing Counterfeit Currency and Account-Balancing Tasks

- Skills for Handling Cheques

Program's Scope

- These training programs help in placing low-income young graduates and those with impediments to employment in entry-level jobs in the banking industry.

- Such training initiatives, which allow them to serve local communities and have access to qualified and job-ready applicants, are also welcomed by the bankers.

- The expansion of the banking industry in India can be attributed to the highly skilled labor force that is produced via training and development initiatives.

- As a result, an initiative to provide those who are struggling to secure employment that leads to a career with a training program of this kind is expected to grow in the upcoming years.

Related products

-

Sale!

Banking Pro – Certificate Programme

₹5,999Original price was: ₹5,999.₹1,999Current price is: ₹1,999. -

Sale!

Certificate In Banking Operations Professional

₹50,000Original price was: ₹50,000.₹1Current price is: ₹1. -

Sale!

Microfinance Interview Training

Rated 1.00 out of 5₹599Original price was: ₹599.₹499Current price is: ₹499. -

Sale!

Certificate in Sales Executive for Microfinance ( CSEM )

Rated 3.60 out of 5₹5,999Original price was: ₹5,999.₹1,999Current price is: ₹1,999.